Gamma

Pioneering Active Liquidity Management

Gamma stands out as one of our premier Automated Liquidity Management (ALM) partners, renowned for their expertise and reliability in managing liquidity positions. They excel in adapting to market dynamics, ensuring that liquidity positions are always optimized for maximum efficiency.

Diverse LP Strategies with Concentrated Liquidity

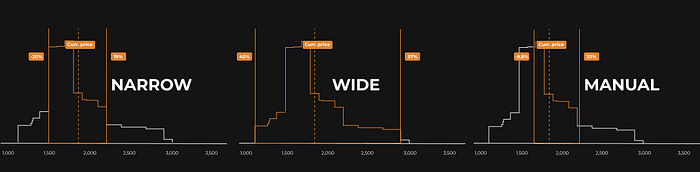

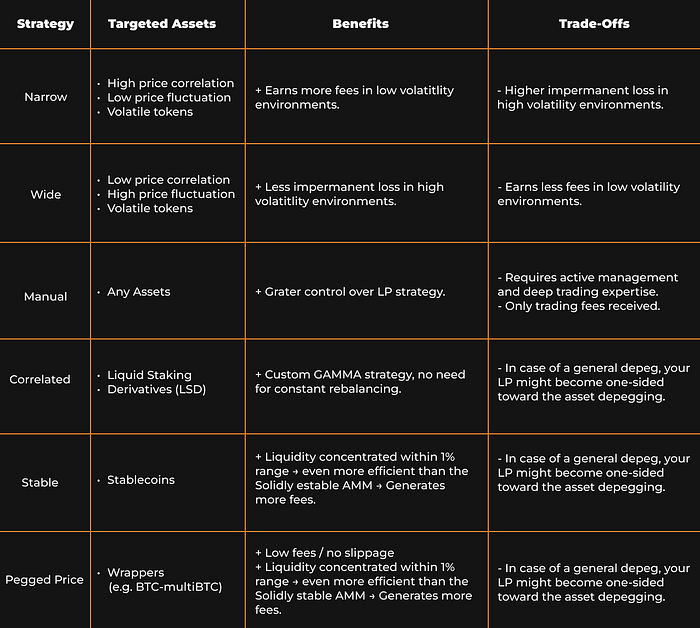

CL offers a broad spectrum of LP strategies catering to various assets, including both volatile and stable types. The platform initially features three main strategies for volatile assets - narrow, wide, and manual modes, with each strategy tailored to fit different market behaviors and asset correlations.

Narrow Range Strategy: Ideal for assets with strong price correlation and minimal fluctuations, the narrow range strategy focuses on a limited price span. This strategy is most effective in low volatility conditions, optimizing fee generation while keeping impermanent loss risks in check.

Wide Range Strategy: Suited for assets with varied price trends and low correlation, the wide range strategy covers a broader price spectrum. It's particularly effective in volatile markets or during events causing high token volatility, such as major updates or news. Although it may incur higher fees, it effectively reduces impermanent loss over the long term.

Manual Range Strategy: Offering tailor-made control, this strategy allows advanced users to set and adjust their desired price ranges in response to market shifts. While it demands active management and forfeits automated Gamma system rewards, it appeals to experienced investors with a keen understanding of market dynamics.

Refer to the summary table for easy comparison of all Gamma strategies below.

For a simplified launch, distinct strategies for Pegged Price and Correlated pools will not be initially supported.

Last updated